Abstract

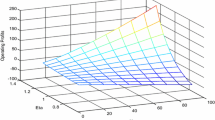

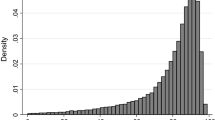

This paper analyzes the association between two firm performance measures: stock market returns and relative technical efficiency. Using linear programming techniques (Data Envelopment Analysis and Free Disposal Hull), technical efficiencies are calculated for a panel of eleven US airlines observed quarterly from 1970–1990. A relationship, between efficiency news in a quarter and stock market performance in the following two months, is found. A risky arbitrage portfolio strategy, of buying firms with the most positive efficiency news and short-selling those with the worst news during this time frame, results in zero beta risk yet yields annual returns of 17% and 18% for the two methodologies.

Similar content being viewed by others

References

Banker, R. D. and H. H. Johnston. (1995). “Strategic Profitability Ratio Analysis: An Application to the US Airline Industry Following Deregulation.” Univ. of Minnesota, mimeo.

Berger, A. N. and D. B. Humphrey. (1991). “The Dominance of Inefficiencies over Scale and Product Mix Economies in Banking.” Journal of Monetary Economics 28, 117–148.

Brennan, M. and T. Copeland. (1988). “Beta Changes around Stock Splits: A Note.” Journal of Finance 43, 1009–1013.

Caves, D., L. Christensen, and W. E. Diewert. (1982). “Multilateral Comparisons of Output, Input, and Productivity Using Superlative Index Numbers.” Economic Journal 92, 73–86.

Caves, R. E. and D. R. Barton. (1990). Efficiency in US Manufacturing Industries. Cambridge: MIT Press.

Caves, R. E. (1992). Industrial Efficiency in Six Nations. Cambridge: MIT Press.

Charnes, A.,W.W. Cooper, and E. Rhodes. (1978). “Measuring Efficiency of Decision Making Units.” European Journal of Operational Research 2, 429–444.

Chopra, N., J. Lakonishok, and J. Ritter. (1992). “Measuring Abnormal Performances: Do Stocks Overreact?” Journal of Financial Economics 31, 235–268.

Cornwell, C., P. Schmidt, and R. Sickles. (1990). “Production Frontiers with Cross-Sectional and Time-Series Variation in Efficiency Levels.” Journal of Econometrics 46, 185–200.

Deprins, D., L. Simar, and H. Tulkens. (1984). “Measuring Labor-Efficiency in Post Offices.” In M. Marchand, P. Pesieau, and H. Tulkens (eds.), The Performance of Public Enterprises: Concepts and Measurement. Amsterdam: Elsevier, 243–267.

Färe, R. (1988). Fundamentals of Production Theory. Lecture Notes in Economics and Mathematical Systems. Germany: Springer-Verlag.

Färe, R. and S. Grosskopf. (1996). Intertemporal Production Frontiers: With Dynamic DEA. Boston: Kluwer.

Good, D. H., L.-H. Roller, and R. C. Sickles. (1993). “US Airline Deregulation: Implications for European Transport.” Economic Journal 103, 1028–1041.

Ibbotson, R. G. (1975). “Price Performance of Common Stock New Issues.” Journal of Financial Economics 2, 235–272.

Ikenberry, D. and J. Lakonishok. (1993). “Corporate Governance through the Proxy Contest: Evidence and Implications.” Journal of Business 66, 405–435.

Kumbhakar, S. C. (1993). “Short-Run Returns to Scale, Farm-Size, and Economic Efficiency.” Review of Economics and Statistics 75, 336–341.

Lovell, C. A. K. (1993). “Production Frontiers and Productive Efficiency.” In H. O. Fried, C. A. K. Lovell, and S. S. Schmidt (eds.), The Measurement of Productive Efficiency. New York: Oxford University Press, 3–67.

Seiford, L. M. and R. M. Thrall. (1990). “Recent Developments in DEA: The Mathematical Programming Approach to Frontier Analysis.” Journal of Econometrics 46, 7–38.

Shephard, R. W. (1970). Theory of Cost and Production Functions. Princeton: Princeton University Press.

Sickles, R. C. (1985). “A Nonlinear Multivariate Error-Components Analysis of Technology and Specific Factor Productivity Growth With an Application to the US Airlines.” Journal of Econometrics 27, 61–78.

Sickles, R. C., D. H. Good, and R. L. Johnson. (1986). “Allocative Distortions and the Regulatory Transition of the US Airline Industry.” Journal of Econometrics 33, 143–163.

Thore, S. (1993). “Cost Effectiveness and Competitiveness in the Computer Industry: A New Metric.” Technology Knowledge Activities 1(2), 1–10.

Tulkens, H. and P. Vanden Eeckaut. (1995). “Non-Parametric Efficiency, Progress and Regress Measures for Panel Data: Methodological Aspects.” European Journal of Operational Research 80(3), 474–499.

Wiggins, J. B. (1992). “Beta Changes around Stock Splits Revisited.” Journal of Financial and Quantitative Analysis 27, 631–640.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Alam, I.M.S., Sickles, R.C. The Relationship Between Stock Market Returns and Technical Efficiency Innovations: Evidence from the US Airline Industry. Journal of Productivity Analysis 9, 35–51 (1998). https://doi.org/10.1023/A:1018368313411

Issue Date:

DOI: https://doi.org/10.1023/A:1018368313411